Industrial Robots Market Size, Share | CAGR of 14.19%

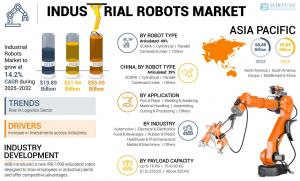

The global industrial robots market size is expected to be worth around USD 55.55 billion by 2032, from USD 19.89 billion in 2024, at a CAGR of 14.19%.

Industrial Robots Market to reach USD 55.55 Bn by 2032 from USD 19.89 Bn in 2024, growing at a CAGR of 14.19%, driven by automation, Industry 4.0, and strong demand in Asia Pacific.”

PUNE, MAHARASHTRA, INDIA, September 24, 2025 /EINPresswire.com/ -- Overview— Fortune Business Insights

The global industrial robots market is experiencing robust growth, reflecting the accelerating pace of industrial automation worldwide. The market was valued at USD 19.89 billion in 2024 and is projected to expand significantly, reaching USD 55.55 billion by 2032. This growth represents a compound annual growth rate (CAGR) of 14.19% during the forecast period of 2025-2032.

Geographically, the Asia Pacific region dominated the market with a share of 48.72% in 2024, driven by its strong manufacturing and automotive sectors. The COVID-19 pandemic had a positive impact, accelerating the adoption of robots in logistics, warehousing, and packaging due to the surge in e-commerce and the need for automated processes.

Get Sample Report PDF| https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/industrial-robots-market-100360

List of Key Companies Studied:

ABB (Switzerland)

YASKAWA ELECTRIC CORPORATION (Japan)

Mitsubishi Electric Corporation (Japan)

NACHI-FUJIKOSHI CORP. (Japan)

Comau SpA (Italy)

KUKA AG (Germany)

FANUC CORPORATION (Japan)

DENSO CORPORATION. (Japan)

Kawasaki Heavy Industries, Ltd. (Japan)

Omron Corporation (Japan)

Staubli (Switzerland)

Universal Robots (Denmark)

Key Drivers / Growth Factors

Rising Adoption of Smart Manufacturing and Industry 4.0

The increasing integration of smart manufacturing processes and Industry 4.0 practices is a primary driver for the market. Industries are rapidly adopting automated robots to enhance efficiency, leading to a surge in demand and market growth.

Growth in Key Industries

The expansion of the automotive and transportation industries is fueling the need for industrial robots to perform critical operations. For instance, Germany's automotive sector grew by 4.2% in 2024 compared to the previous year. Similarly, rising automotive sales in Asia Pacific are leading to increased installations of automated robots.

Increased Investments in Robotics

Substantial investments are being made across various industries, including pharmaceuticals, consumer electronics, and packaging, to optimize operations and reduce expenses. A notable example is ABB Ltd's launch of the IRB 365 delta robot in July 2022, designed for picking and placing lightweight materials with a payload capacity of up to 1.5 KG.

Challenges / Restraints

High Initial Capital and Maintenance Costs

The primary restraint on market growth is the substantial initial capital required for installation and the high ongoing maintenance costs. Industrial robots can cost between USD 25,000 and USD 100,000, posing a significant financial barrier for small and medium-scale enterprises (SMEs) looking to implement production automation.

Opportunities / Future Potential

Growing Adoption in Emerging Economies

Emerging economies like India, China, and Japan are witnessing a rising demand for industrial robots from SMEs. This trend is creating lucrative opportunities for market expansion.

Government Initiatives and Investments

Government and local authorities worldwide are investing heavily in the robotics sector. For example, the "Horizon Program" initiated by European nations allocated approximately USD 780 million in 2020 to advance the robotics market in Europe, signaling strong public sector support for the industry's growth.

Segmentation / Analysis

Analysis by Robot Type

Articulated Robots: This segment held the largest market share in 2024 at 40%. Its dominance is attributed to its high flexibility and wide adoption in applications like welding, painting, and material handling.

SCARA and Cylindrical Robots: These are projected to grow steadily, driven by adoption in the automotive, electronics, and pharmaceutical industries.

Cartesian/Linear and Parallel Robots: These segments are set for moderate growth, favored for their cost-efficiency and flexibility in warehouses and manufacturing facilities.

Analysis by Application

Material Handling: Dominating the market with a 33% share in 2025, this segment is projected to grow at a CAGR of 16.14%. Growth is fueled by its crucial role in the chemical, pharmaceutical, and food and beverage sectors.

Assembling: This segment is anticipated to grow at the highest CAGR of 14.80% during the forecast period.

Welding & Soldering and Pick & Place: These applications show consistent growth, driven by demand from the automotive and electronics industries.

Analysis by Payload Capacity

Up to 16 KG: This segment is projected to dominate with a 42% share in 2025, primarily used for precise handling in the electronics and pharmaceutical sectors.

16 to 60 KG: Expected to expand at the highest CAGR of 14.45%, these robots are popular in the electronics, pharmaceutical, and automotive industries for their high speed and flexibility.

61 to 225 KG and Above 225 KG: These segments will see moderate growth, driven by automation in heavy industries and aerospace.

Regional Analysis

Asia Pacific

Market Value (2025 Estimate): USD 9.69 Billion (2024 Value)

Largest market, dominated by China (USD 6.93 Billion in 2024)

Growth driven by automotive and manufacturing sectors

Europe

Market Value (2025 Estimate): USD 6.57 Billion

Second-largest market

Projected to grow at the highest CAGR of 15.74%

Germany is a key market (USD 2.75 Billion)

North America

Market Value (2025 Estimate): USD 4.15 Billion

Third-largest market

Led by the U.S. (USD 3.4 Billion)

Growth driven by automotive and electronics sectors

Emerging Trends & Technologies

Integration of Advanced Technologies

Industrial robot manufacturers are increasingly implementing advanced technologies such as Artificial Intelligence (AI), machine learning, cloud robotics, and edge computing. These innovations are boosting efficiency, reducing operational costs, and enhancing precision across various industrial settings.

Rise in Logistics and E-commerce

The sustained growth of e-commerce is creating significant demand for industrial robots in logistics and distribution centers. According to the International Trade Administration, global e-commerce sales are anticipated to grow at a rate of 14.4% from 2023 to 2027, directly fueling the need for automated solutions like autonomous mobile robots to improve efficiency and ensure timely delivery.

Get Sample Report PDF| https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/industrial-robots-market-100360

Key Industry Developments:

Sep 2024: KUKA AG launched KR SCARA robot for automotive & pharma sectors; payload 60 kg, high speed & precision, reaches: 800 mm, 1000 mm, 1200 mm.

Oct 2023: ABB introduced IRB 1090 education robot for industrial training; payload 3.5 kg, reach 580 mm, supports programming & simulation software.

Nov 2023: Yaskawa Electric launched MOTOMAN series—adaptive robots for automotive & manufacturing; five types with payloads 4–35 kg.

Nov 2023: Universal Robots opened 1,500 m² facility in Barcelona, producing ~39,000 cobots globally.

Jul 2022: Nachi Fujikoshi launched MZ07LF & MZ07F robots for automotive, electronics & machinery; lightweight, flexible, high-speed, precise handling.

Related Insights:

Service Robotics Market

Logistics Robots Market

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.