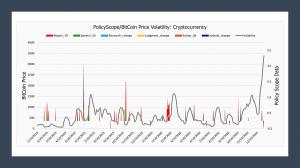

Backtests Confirm PolicyScopeTM Cryptocurrency Data Anticipates BitCoin Price Volatility

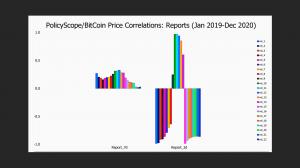

The backtest results validate the value of using objective, quantitative data to measure and anticipate the market reaction function to public policy risks related to digital currencies and crypto-assets.

“It is no secret that the cryptocurrency sector is uniquely exposed to public policy,” said Barbara C. Matthews, Founder and CEO of BCMstrategy, Inc. “Because public policy shifts impact all digital currency issuers horizontally, we expect the Digital Currency data generated by our patented process will generate meaningful and stronger signals of market reaction functions for all cryptocurrency issuers as global central banks accelerate their progress towards sovereign digital currency issuance over the next 18-24 months in particular.” Ms. Matthews additionally noted that “We have been tracking a range of digital currency policy issues since 2019. This means we have the ONLY historical data that pre-dates Facebook’s stablecoin proposal.”

Investors can use the data in multiple ways. The data generated by the automated, patented process delivers actionable signals of activity before headlines have been written, accelerating alpha capture. It can be used within factor analysis and pricing models to generate more accurate measurements of systematic risks within cryptocurrency asset markets. It can also be used to conduct more accurate nowcasting and scenario analysis within risk management.

About the PolicyScopeTM Digital Currency Data: The patented PolicyScope measurement process automatically analyzes and scores daily developments from leading policymakers globally across Europe, Asia, North America, and international bodies. The lexicon currently incorporates 128 technical terms used in the public policy process of both general interest (e.g., cryptocurrency, stablecoin, CBDC) and targeted interest (e.g., AML, data privacy, digital sovereignty).

About BCMstrategy, Inc.: BCMstrategy, Inc. quantifies public policy risks using 9+ layers of patented analytical automation without using sentiment analysis. The company’s PolicyScope data helps capital markets acquire advanced insights regarding global public policy reaction functions by delivering machine-readable, objective structured data, numeric values, and a multivariate historical time series. The complete dataset is available to institutional investors through the Bloomberg Enterprise Access Point (https://eap.bloomberg.com/catalogs/bbg/products/BCMStrategiesPolicyScopeEdition1. Signals derived from PolicyScope data can be accessed through API and FTP feeds (www.policyscope.io).

###

Barbara C. Matthews

BCMstrategy, Inc.

+1 703-401-7239

email us here

Visit us on social media:

Twitter

LinkedIn

PolicyScope/BitCoin Correlation Chartbook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.